Addressing climate change issues — Information disclosure based on TCFD recommendations

Basic approach to addressing climate change issues

The CHINO Group recognizes climate change as one of the most important issues in sustainability management, and is working to appropriately respond to risks related to climate change and seize growth opportunities through collaboration with a wide range of stakeholders in order to contribute to a decarbonized society as outlined in the SDGs and the long-term goals of the Paris Agreement.

In May 2022, our Group expressed its support for the TCFD recommendations, given the importance of disclosing climate change-related information. In the scenario analysis disclosed in the same year, we extracted and qualitatively analyzed important risks and opportunities related to climate change based on a 2°C or less scenario, considered measures to address them, and set goals.

From next year onwards, we will regularly analyze and respond to the risks and opportunities that climate change poses to our business, and expand and update our information disclosure in line with the TCFD recommendations.

In this update (June 2024), we have reanalyzed the financial impact and countermeasures of risks and opportunities related to climate change from both qualitative and quantitative perspectives using multiple scenarios, including a 4°C scenario in addition to a 2°C or less scenario, and have expanded the period of the analysis to 2030 and 2050.

Information disclosure in line with TCFD recommendations

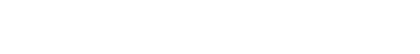

1. Governance

In January 2022, the Group established the Sustainability Promotion Committee, chaired by the President and Representative Director, as an organization to review and deliberate on basic policies and important measures related to sustainability management for the entire Group, including responses to climate change.

The Sustainability Promotion Council is held regularly on a regular cycle every year. We formulate policies on sustainability issues, including climate change, identify materiality, discuss the direction of responses, set KPIs including GHG emission reduction targets, and monitor the status of initiatives. The contents of deliberations and decisions are reported to the Board of Directors as appropriate, and are shared with management, the head office, each business division, and group companies through the Decarbonization Project, CSR Promotion Project, and the Sustainability Planning Office.

In addition, in October 2022, we established the Human Resources & Organization development Committee, chaired by the President and comprised of executive officers, in order to promote human capital management in which management strategy and human resources and organizational strategy are closely linked. The committee takes a bird's-eye view of the overall human resource management system, determines policies for human resource development and measures to improve employee engagement, examines specific measures, and confirms the progress of human resources strategies to promote personnel strategies that contribute to the enhancement of corporate value. The Board of Directors receives reports on the contents of deliberations by the Sustainability Promotion Committee and the Human Resources and Organization development Committee, and deliberates and supervises basic policies and important measures for activities.

■ Roles and activities of each organization

| Meetings/organizations (frequency) |

Role |

Results of Activities |

Board of directors

(14 times a year) |

The Sustainability Promotion Council reports on the matters discussed at the Council and deliberates and oversees basic policy and important measures for activities. |

In April 2023, we will review the activities of the Sustainability Promotion Council and the KPIs for each materiality. |

Sustainability Promotion Council

(Held regularly every year) |

The committee will be established in January 2022, with the President and CEO as chairman.

It formulates policies and monitors initiatives regarding sustainability activities across the entire group, including "responding to climate change."

The matters resolved and discussed at this Promotion Council are also reported to the Board of Directors as appropriate. |

・Set KPIs for each materiality in April 2023

・In November 2023, we will determine specific measures for Scope 1 and 2 reduction and the direction of company-wide sustainability activities. |

Decarbonization Project

(-) |

The company was established in February 2021 to provide new products and services aimed at solving various issues related to marketing to the decarbonization market.

By contributing to the realization of a sustainable society through our group's technologies, we will fulfill our social responsibilities and achieve sustainable growth. |

・Proposing products and systems for the fields of hydrogen, sensors, and monitoring |

CSR Promotion Project

(-) |

Established in May 2021 to raise sustainability awareness among all employees and accelerate activities.

As a company-wide organization, it is configuration of approximately 20 members drawn from each division, and carries out CSR activities and awareness-raising activities at each base and division, as well as updating sustainability issues (materiality), including responses to climate change, and discussing the formulation of draft proposals for setting specific indicators. |

In fiscal 2023, we will work on the theme of making sustainability our own, and in August 2023, we will plan and implement company-wide activities that link each department's operations with sustainability. |

Sustainability Planning Office

(-) |

In order to promote further company-wide efforts to advance sustainability management, the new office will be established within the Business Administration Headquarters on April 1, 2023.

The contents of discussions at the "Sustainability Promotion Council" are shared with the head office, each business division, and each group company, and the progress of the initiatives is monitored. In addition to the progress of initiatives, climate-related issues extracted from each business division and issues currently being implemented are reported to the "Sustainability Promotion Council" as appropriate. |

・In fiscal 2023, we will conduct scenario analysis and calculate the business impact of climate change.

・Calculation of Scope 1 and 2 will be carried out in FY2023 |

2. Strategy

Addressing Climate Change

The Group recognizes the risks and opportunities associated with climate change as one of the important elements of its business strategy, and began a qualitative analysis in line with the TCFD recommendations in 2022. In 2023, we conducted a detailed scenario analysis to further strengthen our analysis and response to the risks and opportunities to our business posed by climate change and their financial impacts.

In addition, when conducting scenario analysis, we refer to the "Recommendations for Developing Business Strategies Using TCFD (issued in March 2023)" published by the Ministry of the Environment and consider both qualitative and quantitative aspects in accordance with the following procedure.

List of anticipated risks and opportunities

Through the above scenario analysis, we have assessed the financial impact of climate change-related risks and opportunities on our Group's business by dividing them into three categories: large, medium, and small. We have then described the matters we have determined to be important in light of our basic policies and strategies related to sustainability management.

In the "Decarbonization Scenario" of 2°C or less, the introduction of carbon pricing (carbon tax), increased manufacturing costs due to rising raw material prices, and increased operating costs due to more energy-efficient air conditioning and updating to manufacturing equipment were identified as important transition risks. In the "Global Warming Progression Scenario" of 4°C, it is assumed that the suspension or stagnation of supply chain operations, including company bases, due to the intensification of extreme weather will have a particularly large impact on business activities as a physical risk.

On the other hand, we see the movement towards a decarbonized society, particularly the progress in hydrogen utilization, the electrification of mobility, the growing demand for replay energy, the shift to EVs due to advances in low-carbon technologies, and the growing demand for monitoring the usage of electricity and other energy, as opportunities to utilize our Group's technologies to solve problems and expand sales.In addition, we believe that the growing demand for high accuracy temperature control in the event of a rise in average temperatures, prediction of abnormal weather, and environmental changes will also be important growth opportunities for our Group's business, which is centered on temperature measurement.

List of identified risks

| Major Category |

Medium classification |

Subcategory |

Idea |

Timeline |

Financial Impact |

Below 2°C

scenario |

4°C scenario |

Estimate |

| risk |

transfer |

Introducing carbon pricing |

The introduction of carbon pricing will increase operating costs according to the company's greenhouse gas emissions |

Short-term to long-term |

During ~ |

- |

○ |

| Energy Use Policy Regulations |

・With the strengthening of renewable energy and energy conservation policies, we are switching to renewable energy electricity and installing solar panels at our production bases.

・Costs incurred for updating or introducing more energy-efficient equipment

・Increased research development costs and procurement costs associated with converting our own products or procured parts to energy-saving models |

Mid to long term |

Big |

- |

- |

| Changes in energy costs |

As decarbonization progresses, demand for renewable energy will increase, and the costs of capital investment in power plants will be passed on to electricity prices, increasing operating costs. |

Mid to long term |

During ~ |

- |

○ |

| Changes in raw material costs |

The introduction of a carbon tax has led to an increase in the cost of raw materials such as metals and plastics, and the switch to environmentally friendly raw materials and supplies has led to an increase in the purchase price of raw materials and manufacturing costs. |

Mid to long term |

Big |

- |

- |

| Impact of reputation changes |

If we fail to respond to climate change, our reputation with customers and investors will deteriorate, leading to reduced sales and difficulties in raising funds. |

Short-term to long-term |

During ~ |

- |

- |

| Physics |

Frequency of abnormal weather (typhoons, heavy rains, landslides, high tides, etc.) |

Damage to our own facilities due to intensifying extreme weather, or disruptions to our supply chains resulting in increased procurement costs or losses due to business interruptions |

Short-term to long-term |

Big |

Big |

- |

| Drought |

The drought has led to a decline in the production volume of semiconductors, which require large amounts of water in their manufacturing process, making it difficult to procure semiconductors for our own production activities and reducing demand for products related to our semiconductor industry, such as temperature measurement equipment. |

Short-term to long-term |

During ~ |

During ~ |

- |

List of identified opportunities

| Major Category |

Medium classification |

Subcategory |

Idea |

Timeline |

Financial Impact |

Below 2°C

scenario |

4°C scenario |

Estimate |

| opportunity |

transfer |

Energy Use Policy Regulations |

・With the strengthening of renewable energy policies, demand for our products that contribute to the research, development, manufacture, and use of hydrogen, biomass, solar power generation, etc. is increasing. ・Demand for our products with low power consumption function designs is increasing.

・Demand for our own equipment and systems that monitor and control temperature and energy usage at manufacturing sites and other facilities is growing due to strengthened energy conservation policies

|

Short-term to long-term |

Big |

- |

- |

| Spread of renewable energy and energy-saving technologies |

Sales of our own products that meet related demand are increasing due to the spread and utilization of renewable energy and energy-saving technologies such as solar power generation, biomass power generation, and hydrogen power generation. |

Mid to long term |

Big |

Big |

- |

| Advances in low-carbon technologies |

・As the shift to EVs continues, cooling technology will be essential to prevent battery deterioration and improve efficiency, leading to increased demand for the company's temperature measurement and control devices.

・With the advancement of low-carbon technologies, including light-weight materials, demand for related products such as our constituent meters is growing |

Mid to long term |

Big |

- |

- |

| Changes in customer behavior |

・Increasing demand for energy-saving products

・Demand is growing for products that manage and improve the energy efficiency of customers and products related to the use of new energy sources such as hydrogen. |

Short-term to long-term |

Big |

- |

- |

| Impact of reputation changes |

- If a company's climate change measures and information disclosure are highly evaluated, its corporate value will increase and opportunities to acquire new customers will expand.

・If a company takes proactive measures against climate change, it will be eligible for ESG investment, and the cost of raising funds will decrease. |

Short-term to long-term |

During ~ |

- |

- |

| Physics |

Rising average temperatures |

The development of greenhouse agriculture, which can adapt to changing weather patterns, is driving demand for indoor temperature and humidity control products |

Mid to long term |

small |

small |

- |

[Time axis] Short-term: 0-3 years Medium-term: 4-10 years Long-term: 11 years~

Estimating the financial impact of risks and opportunities

The degree of financial impact of the risks and opportunities identified above was qualitatively assessed on a three-level scale (large, medium, and small), and then for the risks and opportunities that can currently be estimated, we estimated the financial impact under the 2°C or less scenario and the 4°C scenario for 2030 and 2050 based on external parameter and our actual results.

Estimated financial impact of risks and opportunities

| Prerequisites |

Estimation items |

Estimation results

(unit: 100 million yen/year) |

In the 1.5℃ scenario in 2030, the introduction of carbon pricing would:

We assume that operating costs will increase in accordance with greenhouse gas (GHG) emissions from our energy use. |

-Increasing costs of energy use

*Taxable items of carbon tax (Scope 1 + Scope 2) x carbon tax

* refer: IEA WEO 2023

2030, 1.5℃…140USD/t-CO2

22050, 1.5℃…250USD/t-CO2

*Scope1+2 target = 2030,190t-CO2, 2050,0t-CO2

*USD/JPY 147.53(2024/3/13TTM)

|

2030:3.92

2050:0.00 |

In the 1.5℃ scenario for 2030 and 2040,

As decarbonization progresses, the price of replay energy is rising.

Operating costs are expected to increase in line with electricity consumption. |

・Increasing costs of power procurement

* refer: IEA WEO 2019

(Not reported in WEO2020-2022)

2030, 1.5℃…+15USD/MWh

2040, 1.5℃…+16USD/MWh

*Electricity usage: 5320.2MWh/year

*USD/JPY 147.53(2024/3/13TTM)

|

2030:11.77

2040:12.56 |

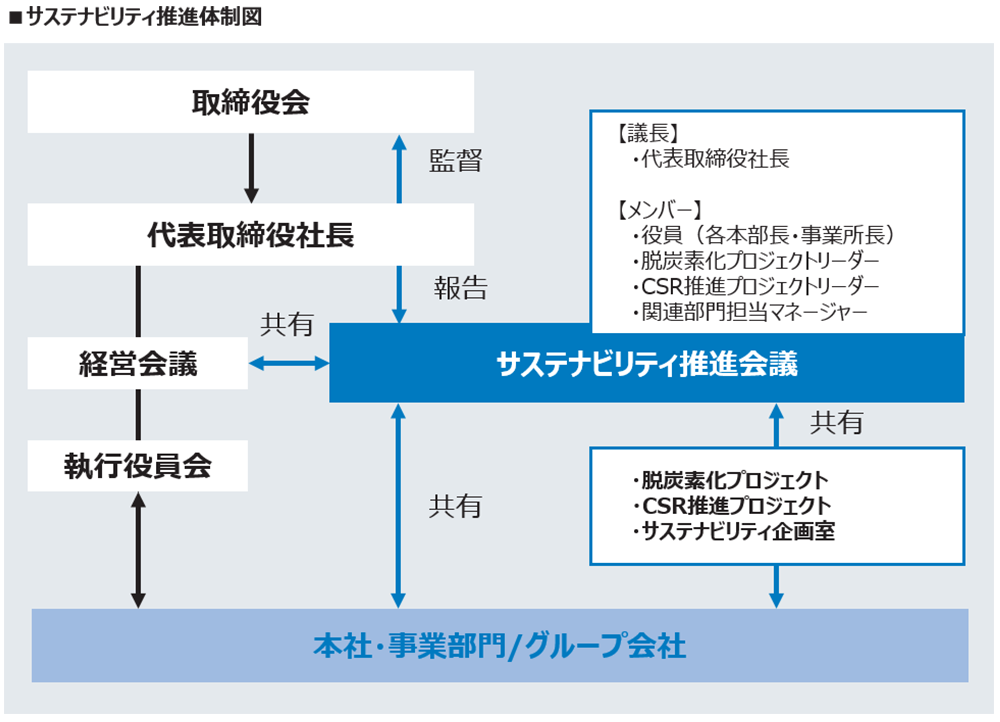

Responses to identified risks and opportunities

In line with our environmental policy, we will divide the countermeasures for the above risks and opportunities into four categories, consider the direction of each initiative, and proceed with them company-wide.

Regarding "reducing GHG emissions," we have switched the electricity purchased at our major domestic bases to replay energy. At the same time, we are accelerating our efforts toward carbon neutrality by promoting activities related to "effective use of resources," such as reducing energy consumption other than electricity and reducing the final disposal volume of waste, while also promoting energy conservation measures at our offices and production bases.

Furthermore, in order to achieve the goals set out in the Ministry of Economy, Trade and Industry's "Basic Hydrogen Strategy," we have positioned "promoting environmental innovation" as one of our environmental policies, and will continue to contribute to the realization of a decarbonized society with the technologies we have cultivated over more than 30 years in the field of utilizing replay energy, including hydrogen.

Furthermore, to maintain physical resilience, we are working to minimize the damage and impact of climate change and to ensure a rapid recovery by taking measures such as strengthening our BCP for when disasters occur, conducting regular drills, and building a global procurement system.

[Strategy] Measures for each category

3. Risk Management

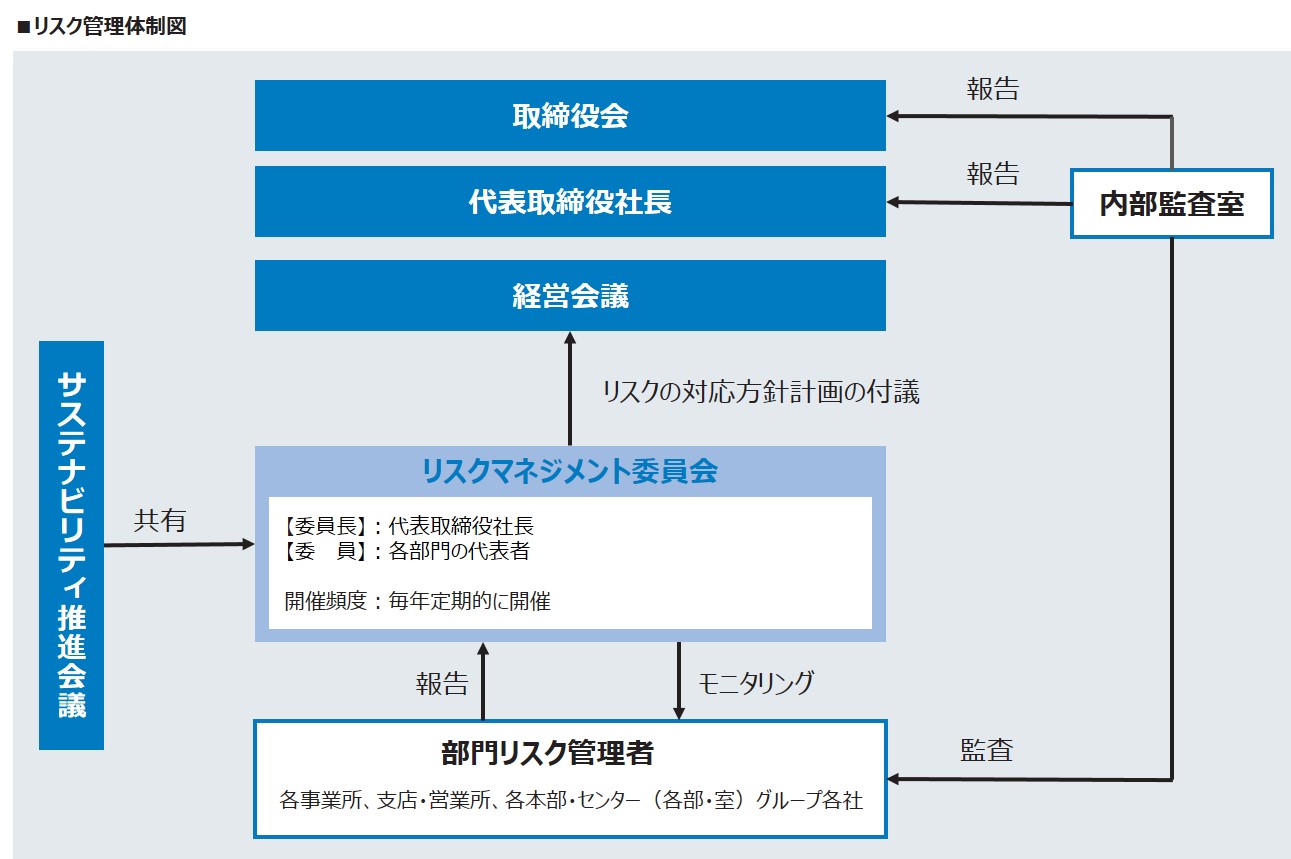

Our group has established the Risk Management Committee as the governing body for risk management, and it meets regularly at a fixed cycle each year. Chaired by the President and CEO, the Risk Management Committee formulates risk response policies, continuously identifies and evaluates company-wide management risks, including environmental issues, prioritizes and decides on countermeasures for critical risks, and monitors the progress of these measures.

Of the above important risks, the risks related to climate change are being examined in more detail at the Sustainability Promotion Council, taking into account the unique time frame and scale of the risks. The Sustainability Promotion Council uses multiple scenarios to qualitatively and quantitatively analyze and evaluate the financial impact of climate change-related risks and future business resilience, and then considers and promotes countermeasures and execution plans. The progress is shared with the Risk Management Committee and ultimately reported to the Board of Directors.

In addition, to ensure that risk management is carried out appropriately, the Sustainability Promotion Council regularly identifies, evaluates and reviews risks related to climate change across the entire Group, and shares the results with the Risk Management Committee.

4. Metrics and Goals

For Scope 1 and 2 (GHG emissions from our business activities), we have set the mid- to long-term goals of "effectively zero GHG emissions by fiscal 2026" and "completely zero GHG emissions by fiscal 2040," and will proceed with various initiatives to achieve these goals.

Going forward, we will be actively working on formulating indicators and targets for the entire group, including consolidated subsidiaries, data logging on Scope 3 (GHG emissions including the entire supply chain related to our business activities) and considering reduction measures.

Major risks and opportunities and our response policy

|

~2022 |

~2026 |

~2030 |

~2040 |

| the goal |

◆Indicator: GHG (greenhouse gas) emissions (Scope 1, 2) ◆Scope: Chino Corporation

◆Base year: FY2020 (FY2020 emissions: [Scope 1: 261t-CO2] [Scope 2: 2,449t-CO2]) |

|

Achieve virtually zero Scope 1 and 2 GHG emissions

(Partial carbon offset used) |

|

Carbon Neutral: Achieving zero Scope 1 and 2 GHG emissions |

| Scope 1,2 emissions 70% reduction (compared to FY2020) |

Scope 1,2 emissions 90% reduction (compared to FY2020) |

Scope 1,2 emissions 93% reduction (compared to FY2020) |

Scope 1,2 emissions 100% reduction (compared to FY2020) |

| Specific Initiatives |

◆ Switch electricity purchased for business activities to replay energy |

Power procurement in stages

replay energy

・October 2021 Yamagata Office

・November 2021 Head Office

November 2021, Kuki Office

July 2022 Fujioka Office |

・Make 100% of our electricity procurement replay energy |

・Power procurement for domestic group companies

100% replay energy |

・All Scope 1 and 2 emissions are sourced from replay energy sources |

| ◆ Scope 3 (supply chain emissions) calculations, goal setting, and emission reductions |

| ◆ Promoting energy conservation and improving the energy efficiency of production facilities |

| ◆ Installation of solar power plants at our business locations (Yamagata Business Site - System capacity 732kWh in 2013, Fujioka Business Site - System capacity 40kWh in 2014) |

Details of the scope of coverage: (Japan) Head office, branches, sales offices, major domestic production bases (Fujioka Office, Kuki Office, Yamagata Office)

GHG (Greenhouse Gas) Emissions (Scope 1, 2) (t-CO2)

|

Fiscal year 2020 (base year) |

2021年度 |

2022年度 |

2023年度 |

FY2026 (target value) |

| Scope 1 (mainly gasoline, LPG, etc.) |

261 |

266 |

265 |

260 |

Scope 1, 2 271 |

| Scope 2 (mainly purchased electricity) |

2,449 |

1,621 |

196 |

31 |

| Scope 1, 2 |

2,710 |

1,887 |

461 |

290 |

| Reduction rate from base year |

- |

30.4% |

83.0% (FY2022 target achieved) |

89.3% |

90.0% |